Payment bonds are a type of surety bond that guarantees subcontractors and material suppliers get paid according to the terms of the contract. The payment bond has a unique standing in the world of construction. It is different than other types of sureties because it ensures subcontractors and material suppliers are paid according to the agreement, which makes them critical for jobs on public property where mechanic's liens (or other types of security interests) cannot be used.

You can now apply online for a Performance/Payment Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

What are Payment Bonds?

A payment bond ensures that subcontractors, suppliers, and laborers are paid according to the terms of a construction contract. This is crucial in both commercial projects and public construction projects, where payment and performance bonds act as a safeguard for all parties involved. For any construction business, payment bonds are a necessary part of securing projects, especially for private projects and state projects. In most cases, labor & materials bonds are typically required to avoid payment disputes and potential lawsuits over unpaid wages or supplies.

How Does a Payment Bond Work?

The cost of a payment bond depends on the bond amount, which is influenced by several factors such as the size and complexity of the project. A bond must remain valid throughout the project duration. Payment bonds are issued by a surety company, which assesses the contractor’s financial statements and determines whether they qualify for the bond. The bond size can vary depending on the contractor’s financial stability and the risk involved. In rare cases, contractors with a strong financial standing may secure bonds at a lower cost.

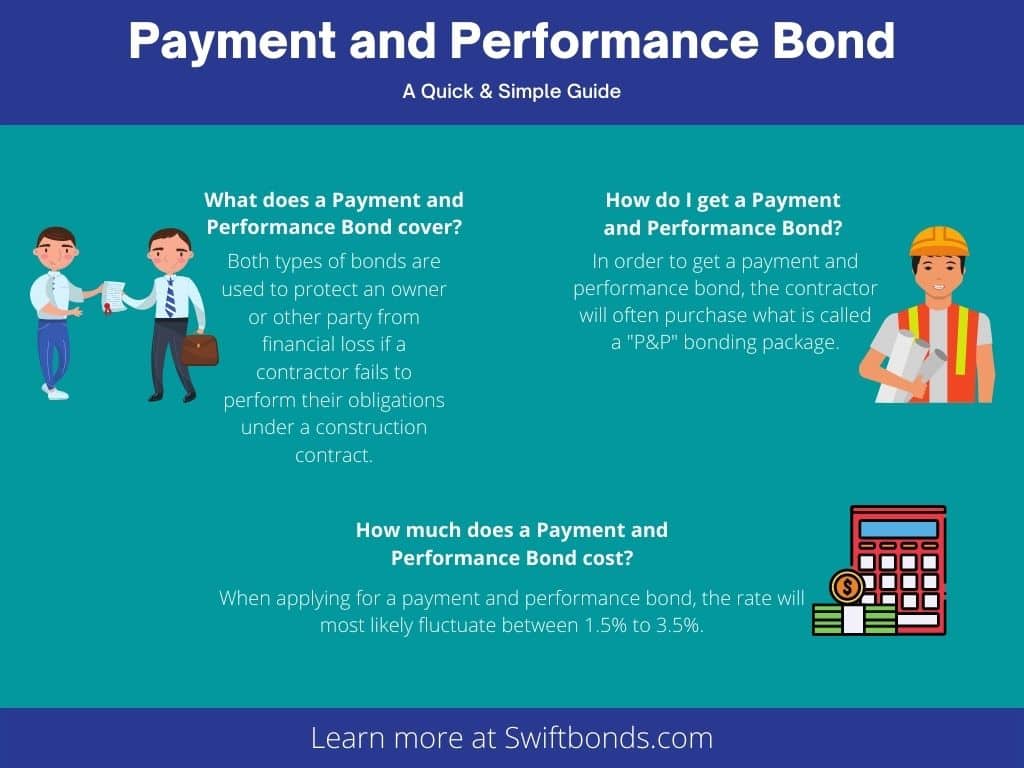

Payment bonds are often paired with a performance bond to cover both payment and performance obligations. These bonds protect general contractors and property owners by ensuring payments are made to all other parties involved in the project, such as subcontractors and suppliers. Contractors must submit all documentation, including financial records, to qualify for these bonds.

Secure your project's success with our reliable construction performance bonds today!

The Miller Act protects subcontractors, suppliers, and laborers in addition to those who work with a contractor. To do so it requires contractors to purchase payment bonds on most state projects.

Who Needs Payment Bonds?

Payment bonds are essential for prime contractors who need to pay subcontractors and suppliers for their work. In many cases, material & labor bonds are required by law for public construction projects, such as those in California and New York, under statutes like the Little Miller Acts. Labor & Material bonds are also important for private projects because they ensure payments are made, preventing mechanic’s liens and lawsuits.

For both public and private projects, a payment surety bond offers financial protection. Contractors who secure a bond can protect their interests and those of their employees. The bond guarantees that payment obligations will be fulfilled, which reduces the risk of non-payment claims from subcontractors and suppliers.

How Much Does a Payment Bond Cost?

The payment bond costs typically range from 1-3% of the total bond amount, depending on several factors, such as the project size, contractor’s financial health, and total amount of the contract. Contractors need to furnish the necessary documentation—such as financial statements—to get approved for a bond. The process involves a review of the contractor’s finances by the surety company.

In rare cases, the cost may be lower for smaller projects, but in most cases, the bond requirement remains between 1-3%. Payment bonds can be a valuable investment, as they prevent costly delays and legal disputes. Securing the right bond can also help contractors improve their chances of being awarded contracts for their next project.

The Importance of Payment Bonds - What are Payment/Performance Construction Bonds?

Payment bonds are critical in protecting the interests of all parties involved in a project. They ensure that suppliers and subcontractors are paid on time, preventing potential lawsuits or financial issues. In many cases, payment and performance bonds are required by law on public projects, making them an essential tool for prime contractors and general contractors.

A contractor’s ability to get a payment bond often depends on their financial health and ability to meet the bond requirement. Contractors who qualify for bonds are seen as less risky by property owners and clients. Knowing the bond is in place provides confidence to everyone involved, especially for large, complex projects.

Steps to Getting a Payment Bond

To secure a payment bond, contractors need to submit an application that includes all required documentation, such as financial statements. The surety companies will review the financials and determine if the contractor qualifies. Once approved, the bond is issued, and the contractor can begin working on the project.

If you’re preparing for your next project, it’s essential to find a bond provider that can help you navigate the complex bond application process. Contractors should ensure they are prepared to meet all requirements, including submitting accurate financials and providing any additional documentation needed. This ensures they can fulfill their obligations and keep the project on track.

You can now apply online for a Payment Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance and Payment Bond Application (click to download form)

- Complete the form and email to gary@swiftbonds.com

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

What happens if you refuse to pay a contractor?

In a payment bond construction contract, if the sub makes a claim, then you could be liable to the payment bond surety for their payout to the subcontractor. Payment bonds construction agreements are clear that the surety would seek reimbursement for any sort of payout under a construction payment bond. A contractor has the ability to place a mechanic's lien on your property if they are not paid. Thus, a payment bond provides significant protection as that would eliminate the need for a mechanic's lien.

Construction projects often involve a large number of subcontractors and suppliers. To ensure that all parties get paid, many construction companies will require a payment bond from the general contractor before any work begins. As an owner, a benefit of a payment bond can provide a level of comfort and security during this process. A payment bond, with a stipulated bond amount, is different than other types of bonds because it ensures that subcontractors and material suppliers are paid according to construction contracts. These bonds aim to prevent damages to parties involved due to non-payment. This means they are critical for jobs on public property where mechanic's liens (or other types of security interests) cannot be used, notably under the agreement with the project owner.

Construction payment bonds are a type of surety bond designed to ensure subcontractors and material suppliers get paid according to contract. They are backed by underwriters and are often required by project owners to safeguard the payments due to the subcontractors and suppliers. Because they provide protection against the risk that one party will not be able to meet the bond requirement, performance bonds can also serve as a construction payment bond. The percentage of bond required can vary between construction contracts. A few key differences between them include:

Payment (labor & material) bonds include both payment to subcontractors as well as material (product) suppliers. The bond amount typically corresponds to a predetermined percentage of the total contract value.

What’s the Difference Between a Performance and Payment Bond?

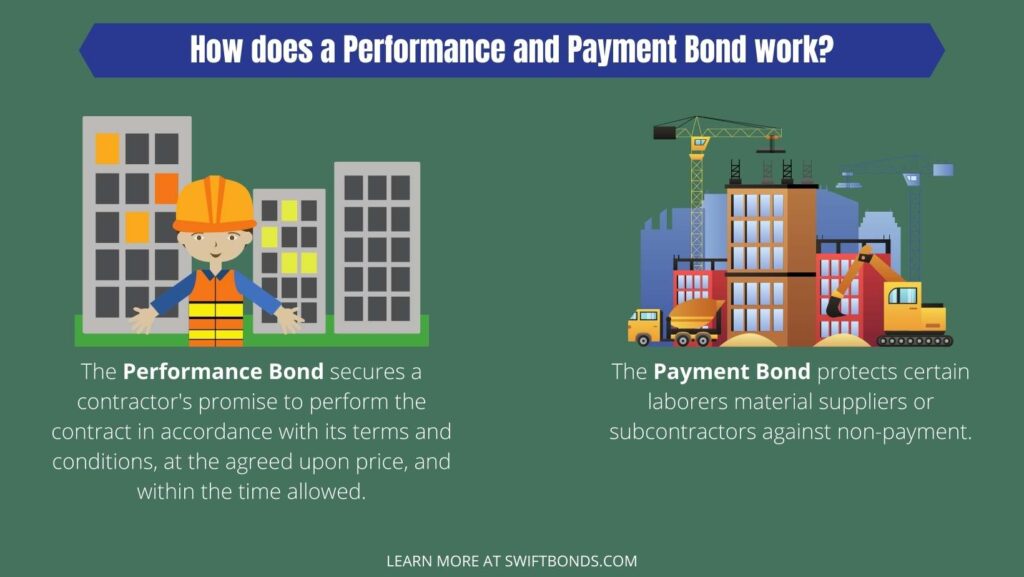

Performance Bonds secures the contractor's promise to perform in accordance with agreed upon terms of contract, at agreed-upon pricing cost. A Payment Bond protects certain laborers against nonpayment from contractors for work done or services rendered. That is the difference between performance and labor and material bonds.

When would you use a performance bonds?

The construction industry is an unpredictable one. One day, work could be proceeding as planned and the next it’s halted because of inclement weather or equipment malfunction. A contract bond protects against these types of risks by ensuring that contractors will complete projects on time and in accordance with the agreed upon specifications to ensure they are compensated accordingly.

How does Payment and Performance Bond work?

How does Payment and Performance Bond work?

A payment bond guarantees that all parties involved with a job will be paid after the work is done, while a performance bond ensures that the build goes smoothly from start to finish so everyone gets what they need when it comes time for final payments at completion.

How Payment Surety Bonds Work on Construction Projects (Payment bond definition construction)

A subcontractor is a person or company that has contracted with another, such as a project owner, to provide labor, services, and/or materials for the completion of a construction project. The payment bond protects them so that they get paid (and don't put a mechanic's lien on the property) as per the agreement.

Construction Payment Bonds vs Performance Bonds

Payment (material and labor) bonds ensure subcontractors and material suppliers get paid according to contract. They have unique standing in the world of construction because they can be used on public projects, as mandated by project owners, to keep the construction moving and not bogged down in legal disputes over payments.

- Performance bonds may have higher premiums than just a payment bond (although they are usually part of the same package)

- Performance bonds require the contractor to provide a surety bond, which is collateral for repayment in case of default

- Payment Bond construction are usually issued by private businesses and not government agencies. They also have lower premiums because they do not carry the financial risk associated with providing collateral.

Join us in building the future—forge a strong bond in construction today!

Facts About Bonds Payment

- Payment insurance bonds are a type of construction payment bond that guarantee payment to all suppliers and subcontractors on a construction project.

- Payment guaran tee bonds are often required by law for public works projects, and may also be required for private projects.

- Repayment bonds are usually purchased by the contractor and are backed by bond companies called a surety company.

- Payment security bonds are typically issued in the amount of the contract, and the surety company is liable for any unpaid debts up to the full amount of the bond.

- Payment bonds are usually required to be in place before work can begin on a project and are often used in conjunction with performance bonds, which guarantee that the project will be completed according to the terms of the contract.

- A Payment of bond are not the same as a lien, which is a legal claim against a property to secure payment of a debt.

- These are also referred to by the following names: P&P Bond; P and P Bond; PNP Bond; Pmt Bond; deifne bond payment

Construction Payment Bonds vs Product Supplier Bonds

Payment bond claims can be complicated to understand. A claim is the right of a subcontractor or supplier that has been paid less than they are owed on an unpaid contract. The following steps will help you better understand how a payment construction bonds work, the associated bond requirement, and what rights your subcontractors/suppliers have when it comes time for them to file a claim.

What is a Payment Construction Bond for Subcontractors?

A subcontractor is a person or company that has contracted with another to provide labor, services, and/or materials for the completion of a construction project. The payment bond protects them so that they get paid (and don't put a mechanic's lien on the property).

Payment surity bonds ensure a contractor's subcontractors, material suppliers, and laborers are protected, essentially shielding them from potential damages. Without this protection, these individuals could grapple with unpaid wages or other debts if the project they were working on was canceled for some reason, leaving them in a dire financial situation.

Guide to Understanding Payment Bond Claims

- Was the work done properly and timely?

- Was the claim submitted timely?

- Is there a dispute with regard to the quality of the work?

- Does the payment bond cover the claim being made?

Payment Bond Statistics

- In the United States, the surety bond industry has an estimated value of $15 billion (USD).

- In 2019, the U.S. surety bond market was estimated to have grown by 5.5% from the previous year.

- Payment bnds are the most commonly used type of surety bond, accounting for approximately 40% of all surety bonds issued.

- In the United States, the surety bond industry is composed of over 4,000 surety companies.

- These bonds are required on most public works projects in the U.S. with a contract value of over $100,000 (USD).

- In 2019, the average payment bond premium rate was 1.5%.

- Payment bond claims accounted for approximately 25% of all surety bond claims in 2019.

- The average payment bond claim amount was $25,000 (USD) in 2019.

Payment bond meaning - It's what people ask for to ensure that material vendors are paid and a mechanic's lien isn't placed against the property. Bonds payment is usually made by the principal.

Payment bonds are a crucial tool for ensuring that everyone involved in a project—whether it’s a public construction project or a private project—is paid for their work. From contractors to suppliers, having a payment bond in place guarantees that payments will be made. Payment bonds are also beneficial for property owners, protecting them from potential issues like mechanic’s liens or non-payment claims. Contractors looking to explore larger projects should invest time in understanding bond programs and securing the right bonds for their needs.

Whether you’re working on a small job or a large, complex project, securing the right types of bonds can make a real difference in the success of your venture. Payment bonds are an important investment in the future of your construction business, protecting your finances and ensuring that payments are made on time.